An overview of the Anti-Money Laundering and Combating of Financing of Terrorism and Financing of Proliferation of Weapons of Mass Destruction Act 2024

Act aims to establish a robust legal framework for preventing and combating money laundering, the financing of terrorism, and the financing of the proliferation of weapons of mass destruction (WMD).

Overview and Purpose

The "Anti-Money Laundering and Combating of Financing of Terrorism and Financing of Proliferation of Weapons of Mass Destruction Act 2024" is a comprehensive piece of legislation enacted by the government of Sierra Leone to address critical financial crimes. The act aims to establish a robust legal framework for preventing and combating money laundering, the financing of terrorism, and the financing of the proliferation of weapons of mass destruction (WMD). This legislation aligns Sierra Leone’s legal system with international standards and obligations, providing mechanisms for effective enforcement and international cooperation.

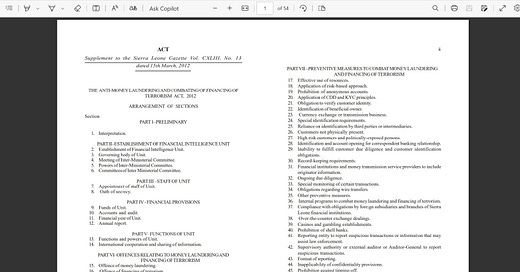

Structure of the Act

The act is divided into several parts, each focusing on different aspects of the law:

Part I: Preliminary

Definitions and interpretation of key terms used throughout the act.

Clarifies the scope and application of the act.

Part II: The Financial Intelligence Agency (FIA)

Establishment of the FIA as an independent body.

Powers, duties, and administrative provisions relating to the FIA.

Part III: The Financial Intelligence Advisory Board

Formation and functions of the Financial Intelligence Agency Advisory Board.

Oversight and policy implementation responsibilities.

Part IV: Administrative Provisions

Roles of the Director-General, Deputy Director-General, and other staff of the FIA.

Protection of officers and provisions for the establishment of departments within the FIA.

Part V: Functions and Powers of the FIA

Exclusive authority of the FIA in handling financial intelligence related to money laundering, terrorism financing, and WMD proliferation.

Responsibilities and powers granted to the FIA.

Part VI: Financial Provisions

Financial management, sources of funds, and auditing requirements for the FIA.

Part VII: Money Laundering

Criminalization of money laundering and associated penalties.

Part VIII: Financing of Terrorism and Proliferation of WMD

Criminalization of financing terrorism and WMD proliferation.

Specific prohibitions and penalties.

Part IX: Preventive Measures

Obligations of financial institutions and other reporting entities to prevent money laundering and terrorism financing.

Part X: Currency Reporting at Points of Entry and Exit

Requirements for reporting currency movements into and out of Sierra Leone.

Part XI: Law Enforcement Measures

Powers granted to law enforcement for investigating financial crimes.

Part XII: Restraint, Seizure, and Forfeiture of Assets

Procedures for asset seizure and forfeiture in connection with financial crimes.

Part XIII: Pecuniary Penalty Orders

Guidelines for imposing financial penalties related to unlawful activities.

Part XIV: Mutual Assistance in Financial Crimes

Provisions for international cooperation and mutual legal assistance in financial crime matters.

Part XV: Offences and Penalties

Detailed list of offences and corresponding penalties under the act.

Part XVI: Miscellaneous Provisions

Additional provisions including inchoate offences, general penalties, and regulations.

Key Provisions of the Act

Establishment of the Financial Intelligence Agency (FIA)

One of the cornerstone provisions of the act is the formal establishment of the Financial Intelligence Agency (FIA). The FIA is designated as an autonomous and independent entity responsible for receiving, analyzing, and disseminating financial information related to money laundering, terrorism financing, and WMD proliferation. The agency’s role is pivotal in coordinating national efforts to combat these financial crimes and ensuring compliance with international obligations.

The FIA is granted extensive powers, including the ability to issue directives, request information, and impose administrative sanctions on non-compliant entities. It serves as the central authority for financial intelligence in Sierra Leone, working closely with other government agencies, financial institutions, and international partners.

The Financial Intelligence Advisory Board

The act establishes the Financial Intelligence Agency Advisory Board, which is tasked with formulating and overseeing the implementation of policies necessary for the FIA to achieve its objectives. The board consists of key government officials, including the Minister of Finance, the Attorney-General and Minister of Justice, and the Governor of the Bank of Sierra Leone, among others. The board’s responsibilities include ensuring the sound financial management of the FIA and providing strategic direction.

The board is also empowered to establish committees to assist in carrying out its functions, particularly in areas such as auditing and compliance.

Administrative Structure and Protections

The FIA is led by a Director-General, who is appointed by the President of Sierra Leone with the approval of Parliament. The Director-General is responsible for the day-to-day operations of the agency, including the management of its funds, property, and personnel. A Deputy Director-General, also appointed by the President, assists the Director-General.

The act includes provisions to protect the members of the FIA and its board from personal liability for actions taken in good faith in the course of their duties. Additionally, all officers of the FIA are required to take an oath of secrecy, underscoring the sensitive nature of their work.

Powers and Functions of the FIA

The FIA is vested with exclusive authority to prevent and combat money laundering, terrorism financing, and the proliferation of WMD. Its functions include:

Receiving and Analyzing Reports: The FIA is responsible for receiving reports from financial institutions and other entities, analyzing them for suspicious activity, and disseminating relevant information to law enforcement and other authorities.

Issuing Directives and Guidelines: The agency can issue regulations, directives, and guidelines to reporting entities to ensure compliance with the law. It can also impose administrative sanctions and penalties for breaches.

Collaboration and Information Sharing: The FIA works with other government agencies, both domestic and international, to share information and coordinate efforts in combating financial crimes.

Training and Public Awareness: The agency provides training to financial institutions and other stakeholders and engages in public education on the dangers of money laundering and terrorism financing.

Criminalization of Money Laundering and Financing of Terrorism

The act clearly defines and criminalizes money laundering, making it an offense to convert, transfer, conceal, or disguise property derived from unlawful activities. It also prohibits the acquisition, possession, or use of such property. The penalties for individuals found guilty of money laundering include fines and imprisonment, with harsher penalties for repeat offenders or those involved in organized crime.

Similarly, the financing of terrorism is criminalized under the act. It is illegal to provide or collect funds with the intention that they be used to carry out terrorist acts. The act also prohibits financing the proliferation of WMD, with severe penalties for those who engage in these activities.

Preventive Measures

The act mandates that financial institutions and other reporting entities adopt robust preventive measures to combat money laundering and terrorism financing. These measures include:

Customer Due Diligence (CDD): Financial institutions are required to identify and verify the identity of their customers and understand the nature of their business relationships.

Know Your Customer (KYC): Enhanced due diligence is required for high-risk customers, such as politically exposed persons (PEPs).

Suspicious Transaction Reporting: Entities must report suspicious transactions to the FIA without tipping off the customer involved.

Record Keeping: Institutions must maintain accurate records of transactions and customer identities for a specified period.

The act also prohibits the use of anonymous accounts and shell banks, further tightening the regulatory environment.

Currency Reporting and Asset Seizure

To prevent the illicit movement of funds across borders, the act requires individuals to report the movement of currency and bearer negotiable instruments at points of entry and exit. Failure to report can result in the seizure of assets.

The act provides law enforcement authorities with the power to seize and forfeit assets connected to money laundering, terrorism financing, and WMD proliferation. This includes the power to restrain property pending investigation and to enforce compliance with restraining orders.

International Cooperation and Mutual Assistance

Recognizing the global nature of financial crimes, the act includes provisions for international cooperation and mutual legal assistance. Sierra Leone commits to cooperating with other states in the investigation and prosecution of money laundering and terrorism financing offenses. The FIA is authorized to enter into agreements with foreign counterparts for the exchange of information and to assist in property tracking and confiscation.

The act also outlines procedures for handling requests from foreign states, including the conditions under which such requests may be refused.

Offences and Penalties

The act details a comprehensive list of offenses and corresponding penalties. In addition to money laundering and terrorism financing, the act criminalizes:

Failure to Verify Identity: Financial institutions that fail to verify the identity of their customers face significant penalties.

Failure to Report Suspicious Transactions: Entities that do not report suspicious transactions to the FIA are subject to fines and other sanctions.

Obstruction of Investigations: Any person or entity that obstructs an investigation by law enforcement or the FIA is liable to prosecution.

False or Misleading Statements: Providing false or misleading information in connection with the act is a criminal offense.

Penalties under the act include fines, imprisonment, and the revocation of licenses for corporate entities.

Miscellaneous Provisions

The act includes several miscellaneous provisions, such as the authority to issue regulations and guidelines to support the implementation of the law. It also provides for the extradition of individuals involved in money laundering and terrorism financing, ensuring that perpetrators cannot evade justice by fleeing to another country.

Finally, the act includes a schedule for the repeal of existing laws that are inconsistent with its provisions, ensuring that there is no overlap or conflict with other legislation.

Conclusion

The "Anti-Money Laundering and Combating of Financing of Terrorism and Financing of Proliferation of Weapons of Mass Destruction Act 2024" represents a significant advancement in Sierra Leone's legal framework for combating financial crimes. By establishing the Financial Intelligence Agency as a central authority and providing it with comprehensive powers, the act aims to ensure that the country effectively addresses money laundering, terrorism financing, and the proliferation of weapons of mass destruction. The act also emphasizes the importance of international cooperation, preventive measures, and strict penalties to deter and punish those involved in financial crimes.

References to Similar Legislation in Other Jurisdictions:

United States:

USA PATRIOT Act (2001): The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act enhances law enforcement’s ability to prevent, detect, and prosecute money laundering and terrorist financing.

Bank Secrecy Act (1970): Also known as the Currency and Foreign Transactions Reporting Act, this law requires financial institutions in the United States to assist government agencies in detecting and preventing money laundering.

European Union:

Fourth Anti-Money Laundering Directive (2015/849): This directive aims to prevent the use of the European Union's financial system for money laundering and terrorist financing. It introduces a risk-based approach to anti-money laundering efforts and strengthens customer due diligence requirements.

Fifth Anti-Money Laundering Directive (2018/843): This directive amends the Fourth Directive, expanding the scope to include virtual currencies and improving transparency regarding beneficial ownership of companies.

Australia:

Anti-Money Laundering and Counter-Terrorism Financing Act 2006: This act provides a framework for detecting and deterring money laundering and terrorism financing in Australia. It imposes obligations on financial institutions to report suspicious transactions, conduct customer due diligence, and maintain records.

United Kingdom:

Proceeds of Crime Act 2002: This act consolidates and strengthens the UK's legislative framework for confiscating criminal assets. It covers money laundering offenses and establishes mechanisms for recovering assets obtained through unlawful conduct.

Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017: These regulations implement the EU's Fourth Anti-Money Laundering Directive and establish requirements for customer due diligence, reporting suspicious activities, and maintaining records.

Canada:

Proceeds of Crime (Money Laundering) and Terrorist Financing Act 2000: This act establishes the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as the central authority for financial intelligence. It requires financial institutions to report certain types of transactions, verify customer identities, and maintain records.

These pieces of legislation across various jurisdictions share common goals and strategies with Sierra Leone’s Anti-Money Laundering Act 2024, underscoring the global nature of efforts to combat financial crimes and the importance of international cooperation in these endeavors. Full text of the Act

The legal community in Sierra Leone can now use eBrief Ready free of charge to collaborate on and prepare matters for court, annotate case law and legislation and prepare court bundles electronically. You can create a free account here.